Creditsafe – how it works

Creditsafe’s rating is a statistical credit rating of a company and forecasts the likelihood of the company becoming insolvent within 12 months. The higher the rating a company has, the less likely it is that the company will go bankrupt. The rating for creditworthiness has an assessment scale of 1 to 100.

Creditsafe’s credit report

Credit rating and scoring model

Creditsafe’s rating system plays a crucial role in assessing companies’ creditworthiness and financial stability. This rating is a summary assessment that reflects a company’s ability to meet its financial obligations and thus its level of risk. The rating system is designed to provide a quick and easy overview to help us make informed decisions about credit, investment and business relationships. Creditsafe’s company rating is based on a number of different factors that together provide a comprehensive picture of a company’s financial health. These factors include, but are not limited to, financial information, payment history, company age and history. Creditsafe’s rating is expressed in ratings between 1-100, where higher values indicate lower risk and greater creditworthiness. This rating is dynamic and may change over time. The advantage of Creditsafe for companies is that the credit information is not shared with other actors, thus the company’s creditworthiness is not affected.

Insamling av data

Creditsafe gives us a comprehensive overview of your company’s financial health, including credit rating, payment history and financial performance. These reports help us make informed decisions in providing the right decision for your business. Creditsafe collects and analyzes financial information from a variety of sources. This includes financial statements, payment history, court records, and other public records. Creditsafe may also include more specific data about industries or regions. Using this information, Creditsafe creates detailed credit reports on companies. These reports often include the company’s credit rating, payment behaviour, financial stability, and history. Since we include guarantor(s) for our loans, we also do a credit check on them to include information about the applicant and the guarantor.

We use Creditsafe’s scoring model for:

Income & assets

Creditsafe look at assessed income, income trends and assets to assess the financial status of the business and the applicant’s personal finances.

Payment behaviour

Creditsafe takes into account the number of payment notices that the company and/or private person has or has had over the years.

Creditsafe vs. UC

The biggest difference between Creditsafe and UC is that Creditsafe’s credit information is not shared with other actors. In this way, the company’s credit rating will not be affected if several credit reports are taken via Creditsafe. This is why many customers search for “loans without UC”, as the company’s credit information is not shared with other credit institutions.

Kreditupplysning på privatperson

Since we only require a personal guarantor as collateral, we also need to take a credit report on you as a private person to ensure that you can stand as a personal guarantor for the loan. The ability to pay is assessed based on the information registered in the credit report, including taxed income, income development, assets and remarks. The basis for the selection is based on a larger fundamental analysis of changes and parameters that directly or indirectly affect a person’s ability to pay.

When making a credit decision, we use Creditsafe to gain a deeper understanding of the company’s financial health and risk profile. Lenders can look at the credit report and rating to judge whether the company is a safe investment.

With Creditsafe’s risk assessment service, we provide a more fair assessment in our credit decisions that we provide to companies.

About Creditsafe

Creditsafe offers a wide range of credit information products and services to businesses of all sizes, including credit reports, business monitoring, risk assessment and business credit scoring. Creditsafe serves as an important tool for lenders in assessing and managing risks associated with business loans, particularly for small businesses where the financial history may be less extensive than for larger businesses.

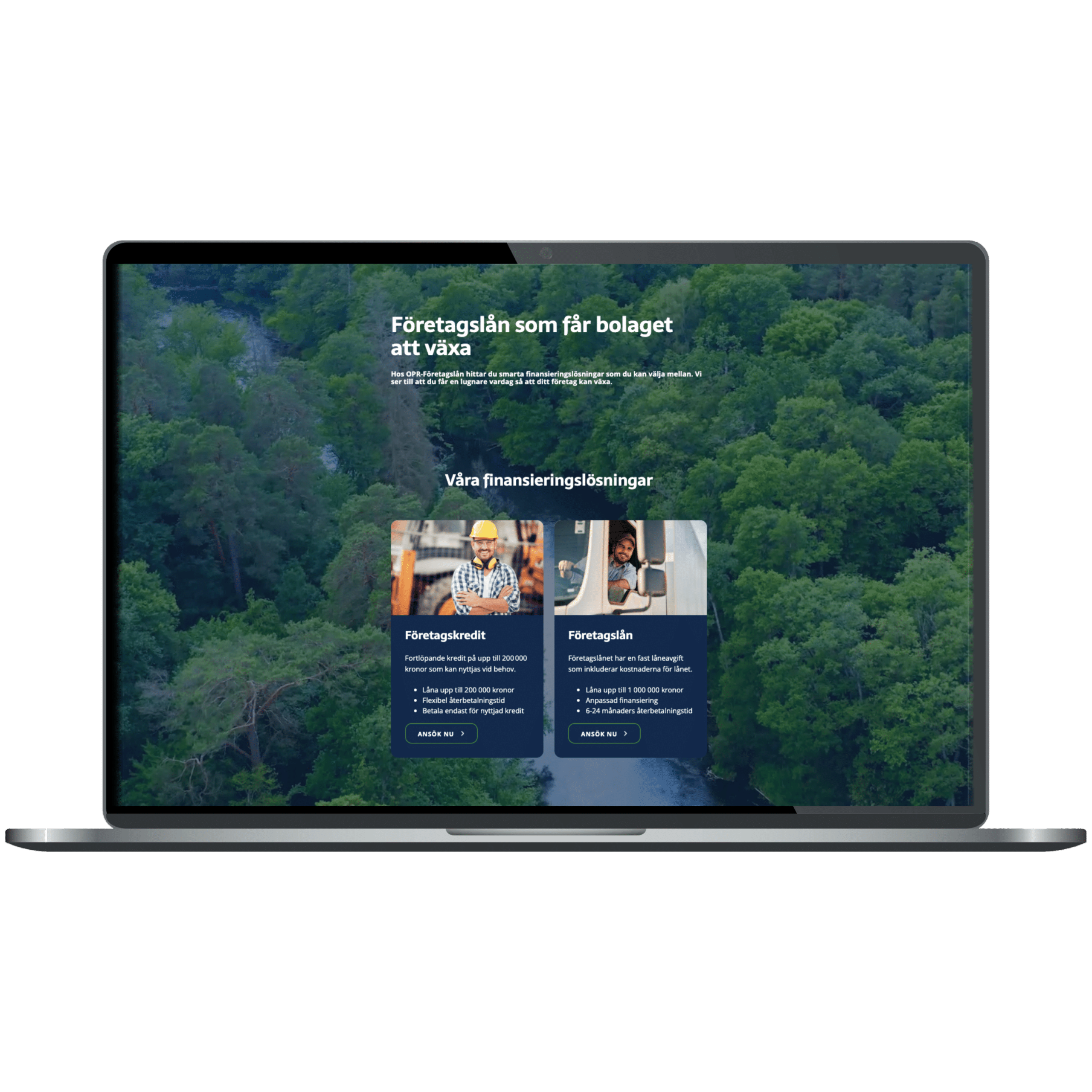

Application process for OPR-Företagslån

- 1. Apply online

You apply for a business loan without collateral or business credit on our website. - 2. Fast response

Apply for a business loan and receive prompt notification so that your business can continue to grow without unnecessary delays. - 3. Sign digitally

You can easily and reliably sign the loan agreement with through our digital signature service. - 4. Payment on the same day

The money is paid out to your company account on the same day as the confirmed agreement.