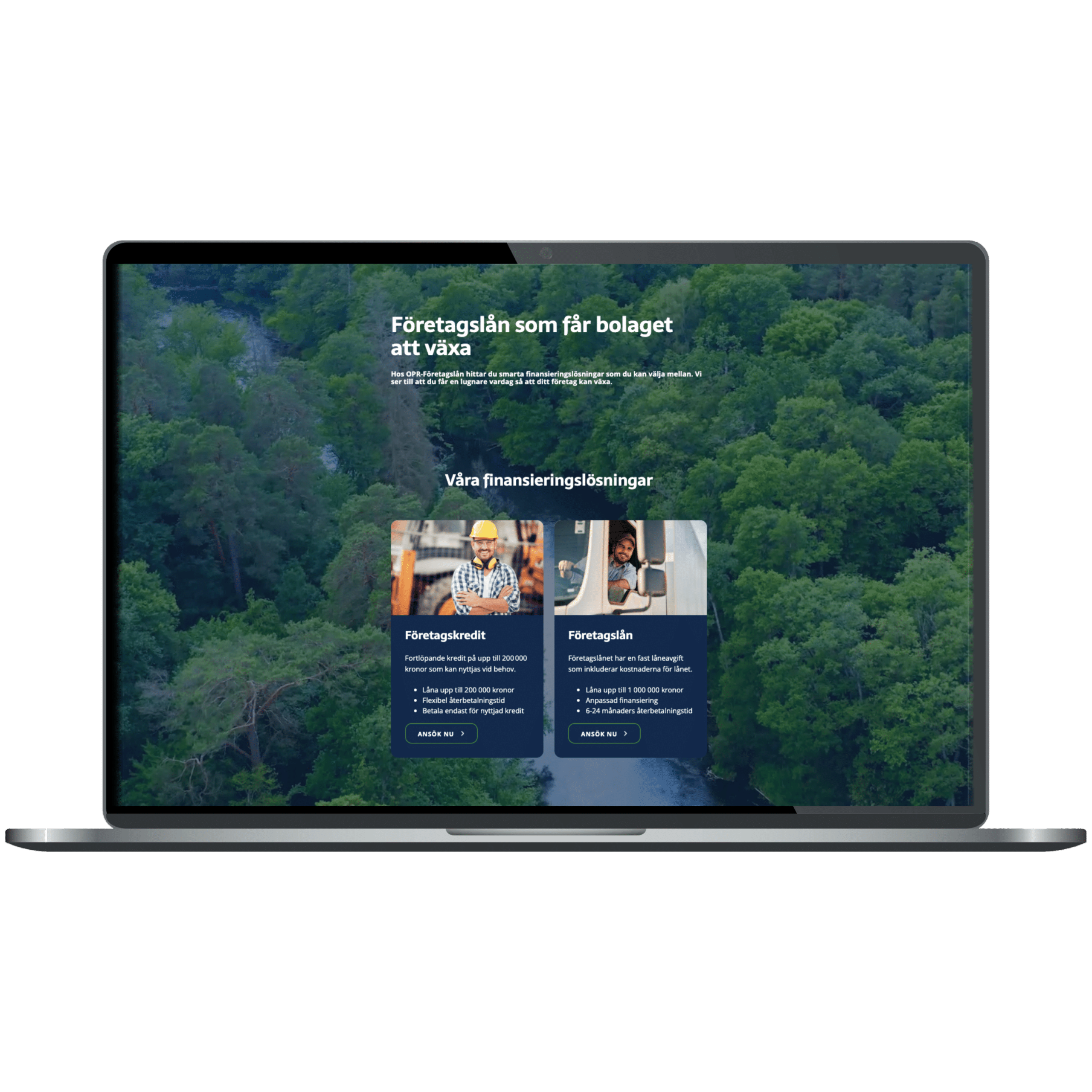

Flexible business loans – quickly and easily.

Apply for a business loan that is tailored to your company’s needs. With up to SEK 1 million in loans, you make sure to strengthen the company’s liquidity.

Loans for entrepreneurs – quick and easy

Our business loan is for entrepreneurs who want a fast and simple loan with good and clear terms without unnecessary hassle, even for you who cannot go in with your own security. With transparent costs, it gives the entrepreneur a good picture of the total loan cost.

Who can apply for a business loan?

A Swedish company that is registered in the Companies Registry can apply for a business loan. You can make an application if you have signature rights in the company either alone or together with others. In order to receive a granted loan, a property guarantee is required.

Loan between SEK 30,000 – 1,000,000 to the company

Up to 24 months repayment period

Digital application process

Apply for a business loan

About our business loan

Fast, simple and clear are the watchwords for us at OPR-Företagslån. We offer loans for your company of up to SEK 1,000,000 for 24 months without unnecessary hassle.

Our business loan always has a fixed loan fee that includes all costs for your loan, the price of your loan is based on a credit assessment by the company. In this way, you always know before you apply what you will have to pay back and thus avoid unpleasant surprises. Repayment takes place in equal monthly installments.

In order for us at OPR-Företagslån to be able to offer you a loan, it is necessary that your company has a relative good credit rating and that a private person stands surety for the loan (two people for loans over SEK 200,000). You can easily apply online 24/7 using your BankID. The guarantors must give their commitment before the loan processing can begin.

If you have any questions about our loans or how to apply, you can read our answered questions below, you can also contact our customer service which is here to answer your questions.

As a business loan customer, you get…

Quick response of your loan application

The money in the account the next banking day

Finance the growth and development of your company’s operations

Balancing cash flow fluctuations

Transparent pricing for loans to businesses

Finance your business without collateral

How to apply for a business loan online

- 1. Apply for a business loan

Make an application on the website. Our credit officers then process your application. - 2. Accept the loan offer

If everything looks good, you will receive a digital loan offer from us. If you are satisfied with the terms, you accept. - 3. Signera digitalt med BankID

You accept the terms by signing securely with BankID. - 4. Pengarna på kontot nästkommande bankdag

After everything is signed and ready, the money comes in the next banking day.

FAQ

- Which companies can apply for a business loan?

All Swedish limited companies, sole proprietorships, trading companies and limited partnerships can apply for a loan with us.

- How does the business loan work?

We offer a flexible and simple business loan from SEK 30,000 to SEK 1,000,000 with a repayment period of between 6-24 months. You repay the loan with a fixed amount every month without any hidden fees.

- What collateral is required to get a loan?

We do not require any collateral from the company. You will have to provide a personal guarantee for loans up to SEK 200,000. For loans over SEK 200,000, two people need to be personal guarantors for the loan.

- What does a personal guarantor mean?

When a private person guarantees the loan through a personal guarantee, he or she is responsible for the debt as if it were his or her own. If the original debtor defaults, the guarantors are required to pay the full amount, including expenses, interest and collection costs.

- Do you take a credit report on the guarantor?

Yes, we take a credit report with Creditsafe. A credit report from Creditsafe affects neither rating, scoring nor future credit assessments of other actors.

- Can I pay back my loan early?

Yes, it is entirely possible to terminate the loan early. You need to contact our credit officers to get a correct amount for the final payment.

- Do you have invoice fees or hidden fees?

No, there is no invoice fee or other hidden costs. The fixed monthly cost covers all administrative expenses, so you avoid unpleasant surprises.

- Can I get a loan despite a payment notice?

Yes, it is possible to get a loan granted with us even if you have a payment note. We look at a number of different factors when we process your loan, and a payment notice does not automatically mean no.

Apply for a loan for companies with BankID – decision the same day

OPR-Företagslån offers transparent and simple financing between SEK 30,000 – 1,000,000 with a repayment period between 6-24 months. A business loan is particularly suitable for working capital, support for cash flow management and financing for investment or business growth.

Applying for a loan with OPR-Företagslån is done conveniently online, when it suits the person responsible for the company best. You do not need real collateral to apply for a loan, but it is the applicant who stands as the property guarantor. With us, your loan application is always processed by our skilled credit officers.

We process your application quickly – you get a loan decision today and the money in the company’s account no later than the next banking day. The business loan is offered to you by OPR-Finance AB, which is part of the Finnish OPR-Finance-group