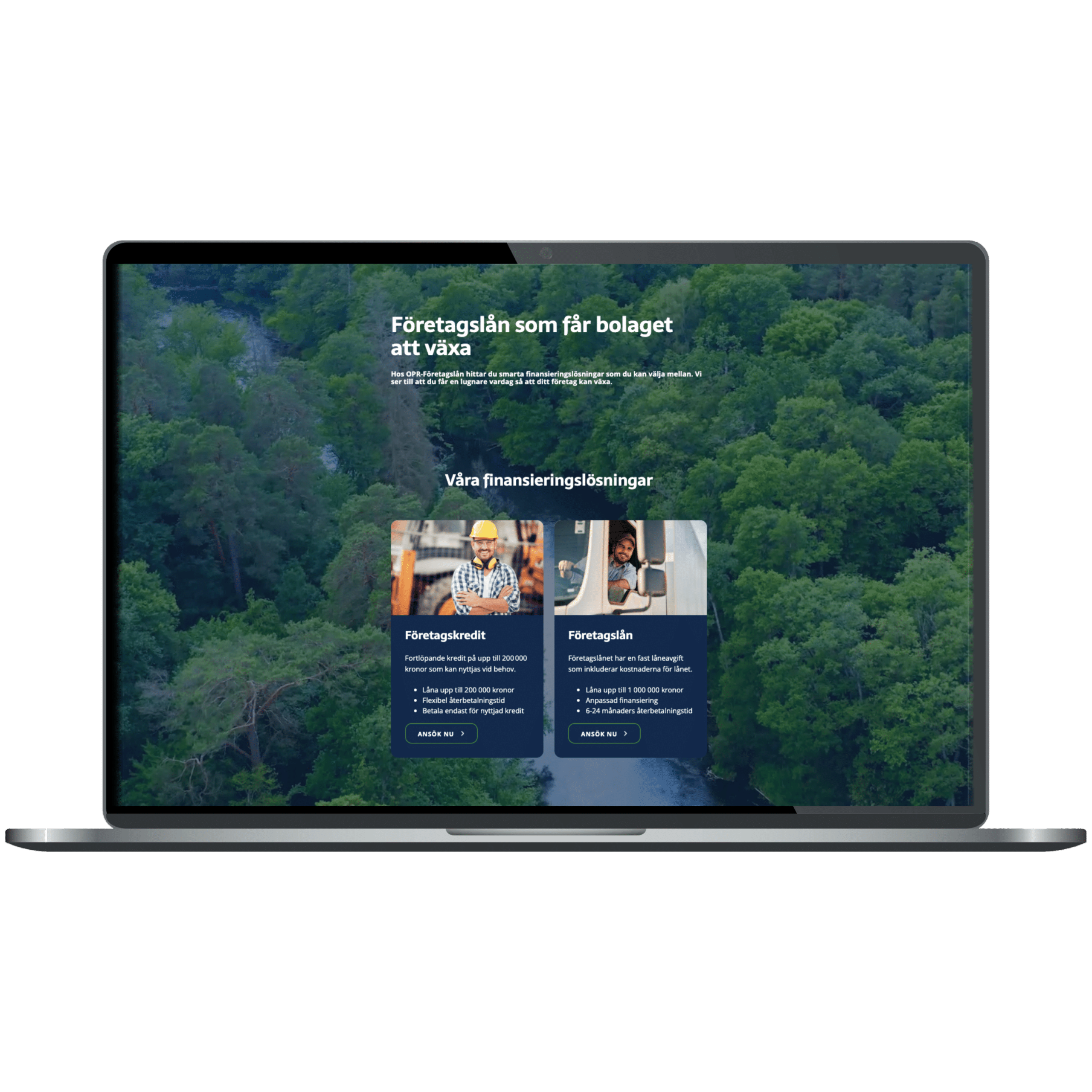

Business loan that makes the company grow.

At OPR-Företagslån you will find smart financing solutions that you can choose from. We make sure that you have a calmer everyday life so that your business can grow.

Our financing solutions

Business credit

Continuous credit of up to 200 000 SEK that can be used when needed.

- Credit up to 200 000 SEK

- Flexible repayment

- Pay only for used credit

Business loan

The business loan has a fixed loan fee that includes the costs of the loan.

- Loan up to 1 000 000 SEK

- Customized financing

- 6-24 months repayment period

OPR-Företagslån – The company of small entrepreneurs

As a small business owner, it is sometimes difficult to predict the company’s financing. New investments and unforeseen expenses may require that money is quickly available, but for those of you who have just started your business or have uneven incomes, it can unfortunately be difficult to borrow money before it is too late. It was with Sweden’s small business owners in mind that we at OPR-Företagslån started our business.

Our business concept is to offer fast and simple loans with good and clear conditions without unnecessary hassle, even to those who cannot go in with their own security. We believe in small businesses and know that you who work and live with your dream have the necessary drive to succeed with your project – therefore we can offer loans to you who otherwise have difficulty getting loans.

Application process for OPR-Företagslån

- 1. Apply online

You apply for a business loan without collateral or business credit on our website. - 2. Fast response

Apply for a business loan and receive prompt notification so that your business can continue to grow without unnecessary delays. - 3. Sign digitally

You can easily and reliably sign the loan agreement with through our digital signature service. - 4. Payment on the same day

The money is paid out to your company account on the same day as the confirmed agreement.

As a customer of OPR-Företagslån, you get…

Fast handling

Apply for a loan and receive prompt notification so that the company can continue to grow without unnecessary delays.

Clear pricing

Clear loan costs make it easier for companies to get a better understanding of the financial terms of the loans.

Opportunity for growth

Invest in your company with the business loan or handle unexpected invoices with the business credit.

Fast payment

The money is sent immediately after the agreement is confirmed.

Balanced cash flow

Balance the cash flow and counteract seasonal sales and late payments.

Business loans without collateral

We only require a guarantor for our loans.

Statistics on OPR-Företagslån

SEK in total lending to companies in Sweden

Customers all over Sweden

Satisfied customers according to TrustPilot

Years of experience in corporate financing

About OPR-Företagslån

OPR-Företagslån is a service under OPR-Finance AB, which is a Swedish company licensed by the Financial Supervisory Authority to conduct financing activities. The owner is OPR-Finance Oy with headquarters in Helsinki, which since its inception in 2005 has helped over 300,000 companies and individuals with financing in several European countries. In addition to consumer credit solutions and corporate financing, OPR-Finance Oy provides payment solutions for online stores as well as an innovative investment service for private investors.

FAQ – OPR-Företagslån

- What is OPR-Företagslån?

OPR-Företagslån has existed since 2016 and offers both business loans in Sweden and business credit. OPR-Företagslån always strives to be the fastest on the market.

- Who can apply to OPR-Företagslån?

All Swedish limited companies, sole proprietorships, trading companies and limited partnerships can apply for an unsecured business loan with us.

- What collateral is required?

We do not require any collateral from the company. You will have to provide a personal guarantee for loans up to SEK 200,000. For loans over SEK 200,000, two people need to be personal guarantors for the loan.

- How is my company assessed?

We make an overall assessment and are supported by various services such as CreditSafe and Kreditz.

- Is a credit report taken in the application?

Yes, we take a credit report with Creditsafe. A credit report from Creditsafe affects neither rating, scoring nor future credit assessments of other actors.

- How do I apply with my company?

You apply easily via our website using a regular or mobile BankID. If the loan is approved, we transfer the money directly.