The company of small business owners.

Swedish small business owners are the backbone of Sweden and are crucial for creating growth and employment. Despite this, they often face funding challenges. We are here to offer a tailored solution for you.

Small business owners and the challenge of financing

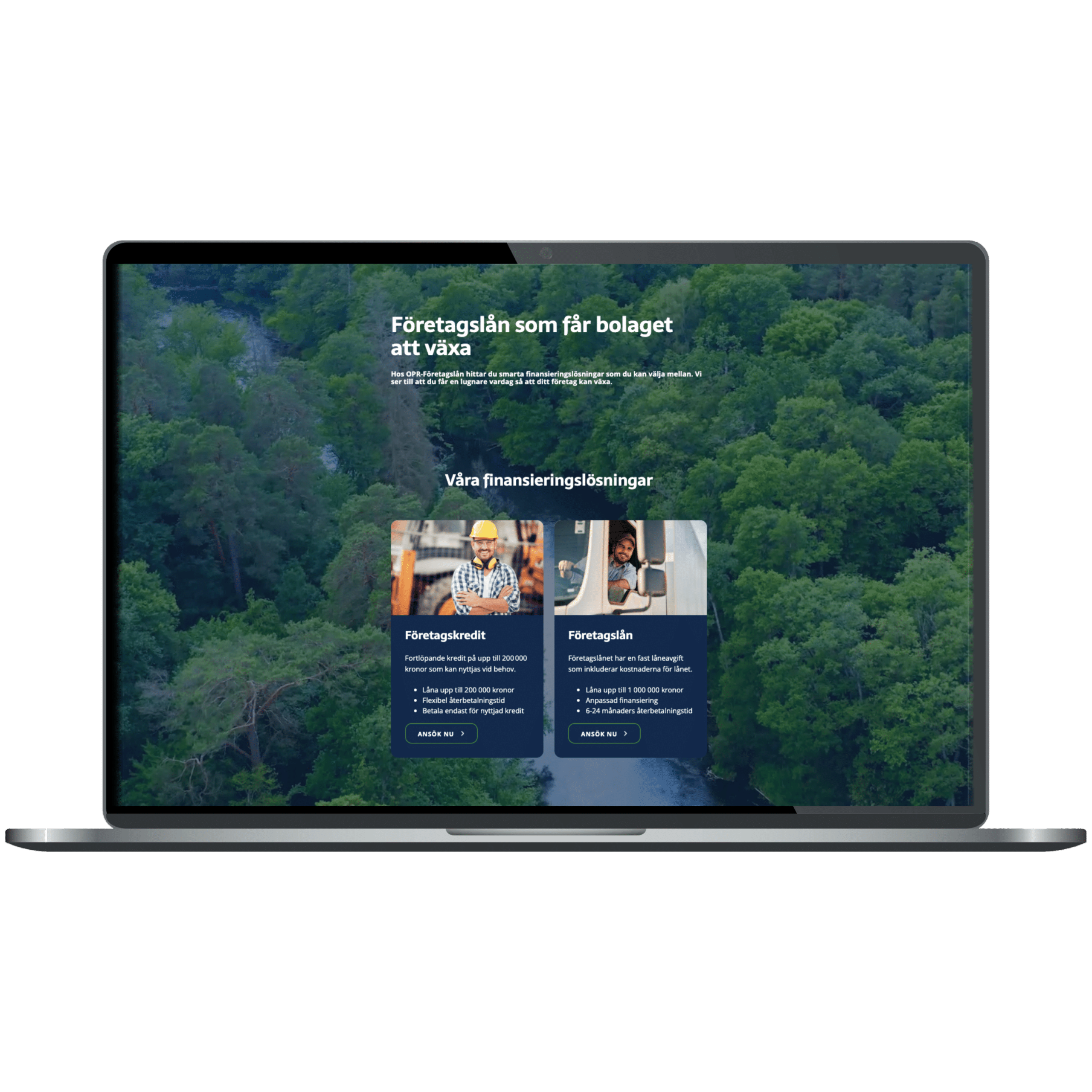

Swedish small business owners make up a significant part of the country’s economy and are crucial for creating growth and employment. The fact is that a whopping 97 percent of Sweden’s entrepreneurs consist of small businesses. Despite this, they often face challenges when it comes to financing and access to capital. OPR-Företagslån puts the entrepreneur in focus by offering a tailored solution for customers.

OPR-Företagslån looks at the big picture for small businesses

Small business owners have long struggled to get financing from big banks. One of the biggest reasons why many find it difficult to get financing from big banks is because of the lack of security. Many banks do not always take into account the specific circumstances, which can lead to many being denied funding.

How to apply for a business loan

- 1. Apply online

You apply for a business loan without collateral or business credit on our website. - 2. Fast response

Apply for a business loan and receive prompt notification so that your business can continue to grow without unnecessary delays. - 3. Sign digitally

You can easily and reliably sign the loan agreement with through our digital signature service. - 4. Payment on the same day

The money is paid out to your company account on the same day as the confirmed agreement.

OPR-Företagslån helps small businesses with unsecured loans

One reason why small businesses find it difficult to get financing from big banks is because of the requirement for security. Large banks often require collateral in the form of assets or real estate to grant loans. This is especially difficult for start-ups that may not have enough assets or real estate to use as collateral. Even if the company has assets, it is not always enough to secure a loan.

Another reason why many small businesses find it difficult to get financing from big banks is because of their size. These companies are often too small to generate enough revenue or profits to meet the banks’ credit terms. Banks may also be reluctant to provide loans because of the risk that the business may fail or go bankrupt.

To solve these problems, alternative financing options, such as OPR-Företagslån, have become increasingly popular for owners. OPR-Företagslån is an alternative source of financing that offers business loans and business credit. Instead of relying on traditional credit rating models or collateral requirements, OPR-Företagslån uses a different method to assess the creditworthiness of companies.